托福独立写作考试的时候,想要在短短的托福考试时间内,找到文章最好的切入点,其实并不是那么容易的。所以,在备考过程中,我们的托福写作练习,并不需要把所有的文章进行完整的练习,而是要就题库中的文章都建立好明确的论点和论据。本文小编就为同学们带来托福写作语料库之欧洲的电子税,希望能为大家能为托福备考带来帮助。

Big technology firms(科技公司) face paying more tax under plans announced by the European Commission(欧盟委员会).

It said companies with significant online revenues(收益) should pay a 3% tax on turnover(营业额) for various online services, bringing in an estimated €5bn (£4.4bn).

The proposal(提案) would affect firms such as Facebook and Google with global annual revenues above €750m and taxable(达到征税水平的) EU revenue above €50m.

The move follows criticism that tech giants(科技巨头) pay too little tax in Europe.

EU economics affairs commissioner(专员) Pierre Moscovici said the "current legal vacuum(法律真空) is creating a serious shortfall(缺失) in the public revenue of our member states".

He stressed(强调) it was not a move against(针对) the US or "GAFA" - the acronym(首字母缩略词) for Google, Apple, Facebook and Amazon.

According to the Commission, top digital firms pay an average tax rate of just 9.5% in the EU - far less than the 23.3% paid by traditional companies.

Its figures are disputed by(被反驳) the big tech firms, which have called the tax proposal "populist(平民主义的) and flawed(有缺陷的/有漏洞的)".

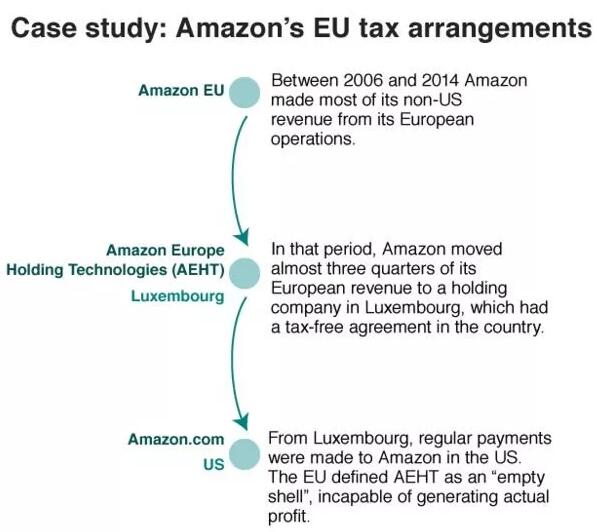

Countries including the UK and France have accused firms of(指责) routing some profits(谋利) through low-tax EU member states such as Ireland and Luxembourg.

Big US tech companies have argued they are complying with(遵守) national and international tax laws(税务法).

However, the Commission said it wanted to tax(对......征税) companies according to where their digital users are based.

The tax would only apply to(适用于) certain online revenue streams(营收渠道), such as online advertising in search engines(搜索引擎的在线广告) or social media, online trading, or the sale of user data.

The proposals require backing from the European Parliament and the 28 EU countries, but they are divided on the issue(对此意见不一致).

EU tax reforms need the backing of all member states to become law.

Ireland has warned that the proposals may not yield(产生) more tax, while some countries believe smaller companies should also face a bill(支付费用).

The business practices(商业行为) of big tech firms are facing growing scrutiny(面临越来越多/严厉的审查) in Europe.

Competition regulators have fined(罚款) Apple and Amazon, while Google is appealing against(上诉) a record €2.4bn fine for abusing(滥用) its dominance(主导地位) to favour(偏袒) its own shopping services.

EU agencies are also set to tighten(加强) rules on data privacy, while Germany has introduced big fines for social media firms who fail to take down extreme content(下架过激的内容) quickly enough.

托福写作题目:

1. The gap between the rich and the poor is becoming wider. What are the possible reasons and what can be done to improve the situation?

2、Some people think developing countries should invite foreign companies to open branches, offices and factories to promote their economies. Others say that they should keep the foreign companies out and depend more on their own local companies. Discuss both these views and give your own opinion.

本文还可以适用于企业的社会责任这个托福写作话题

3、As well as making money, businesses also have social responsibilities. To what extent do you agree or disagree?

以上就是小编为同学们带来的托福写作语料库之欧洲的电子税的内容,希望能够帮助正在备考托福的同学们!

相关资料

相关推荐

-

托福作文怎么写 能得高分

2024-02-19![托福作文怎么写 能得高分]()

-

托福环保建筑话题 范文

2024-02-22![托福环保建筑话题 范文]()

-

托福到底能考多少分?19年必练真题告诉你答案

APP专享![托福到底能考多少分?19年必练真题告诉你答案]()

-

托福写作部分怎么写好一点

2024-02-21![托福写作部分怎么写好一点]()

-

托福写作有几种题型

2023-05-05![托福写作有几种题型]()

-

托福gre作文区别是什么

2023-11-23![托福gre作文区别是什么]()

-

托福写作考查哪些内容

2023-11-15![托福写作考查哪些内容]()

-

托福写作新旧对比技巧

2023-12-19![托福写作新旧对比技巧]()

-

托福写作详解怎么写好

2023-11-20![托福写作详解怎么写好]()

-

托福写作细节怎么写 容易得高分

2024-02-20![托福写作细节怎么写 容易得高分]()

-

满分托福写作怎么写

2023-05-11![满分托福写作怎么写]()

-

托福学术写作思路

2023-12-04![托福学术写作思路]()

-

托福复述文章怎么写

2023-11-21![托福复述文章怎么写]()

-

托福独立写作作文格式

2023-11-09![托福独立写作作文格式]()

-

托福写作场景描写

2023-11-07![托福写作场景描写]()

-

专业托福写作攻略

2023-05-18![专业托福写作攻略]()

-

托福写作练习书 推荐

2024-01-12![托福写作练习书 推荐]()

-

托福gre写作高分思路总结

2023-12-20![托福gre写作高分思路总结]()

-

托福作文如何获得高分

2023-11-07![托福作文如何获得高分]()

-

托福写作的基础词汇有哪些

2023-11-03![托福写作的基础词汇有哪些]()

-

新托福写作解析

2024-02-02![新托福写作解析]()